Description

One Month Analysis of Your Personal Skills for Day Trading Peak and Wane Time and Date.

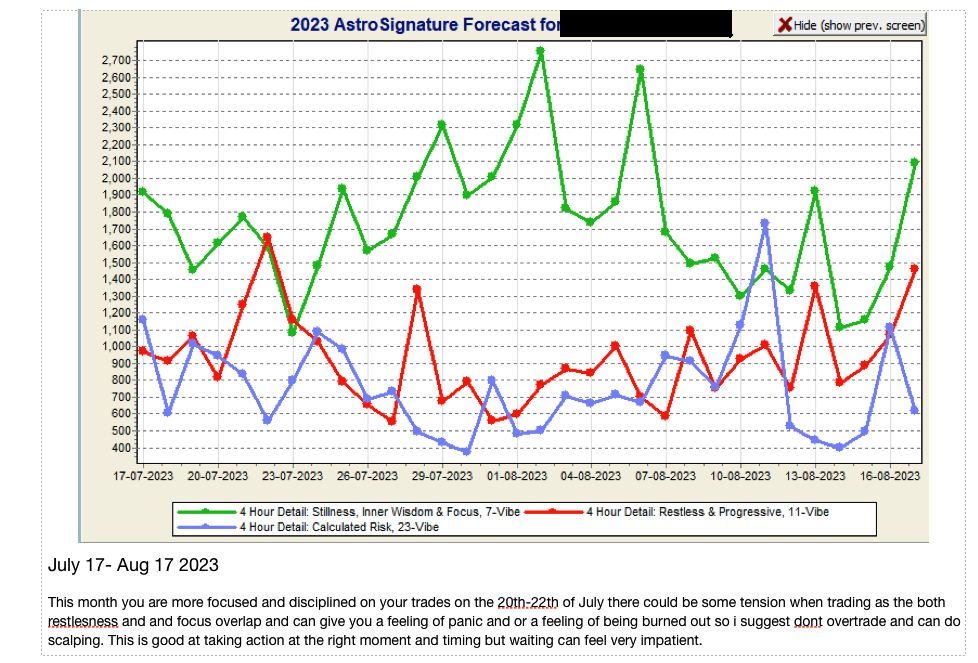

The timeline profile is easy to read and hardly requires any instructions. The names of the days and times appear on the bottom and the different colored lines interpret the strength of the energy characteristics.

There are four characteristics which is 1. Stillness, inner wisdom, and focus, 2. Restlessness and Instability, 3. Calculated risk or risk assessment and 4. Mental acuity. These four characteristics are important on being a trader as it can determine when would be your good days and time to trade and when to avoid and just observe the market.

Let’s use for example

- Stillness, inner wisdom, and focus mean on the days and time when your focus and discipline are starting and peaking you are more eager to wait for a low-risk high reward entry and you are more patient to wait for long-range tp targets. When it’s low, it doesn’t mean that you are going to be bad at discipline and focus when it’s not at peak, but you are likely not as patient and disciplined as usual.

- Restlessness and Instability on the days and times when your restlessness and instability are at their peak you want and more progressive and fast-moving market and you may feel impatient and anxious if the market is slow.

- Calculated risk or risk assessment on the days that your calculated risk is starting and peaking you are better than usual in managing your account and you calculate how much risk you can avoid or are willing to take to get a good reward.

- Mental Acuity On the days that your mental acuity is strong and peaking you are likely to make good sound judgment on the market and the risk for you to get confused is low.

Let’s talk about overlap because there are days when focus and discipline are both strong, or more than 3 are strong.

- When stillness, inner wisdom and focus, and calculated risk both overlap and at their peak, this is a good day for you to make long-term trades, trades that you can hold for more than 4 hours or days.

- When Restlessness and Instability and calculated risk both overlap and are at their peak, it is good that you do scalp since scalping is a faster trading technique that requires quick decision-making in and out. Also, avoid overtrading and drinking too much caffeine as this energy can cause insomnia a good mental acuity combination should be added to this energy.

- Some bad days are overlapping of focus and instability as this stresses traders especially when calculated risk is not present.

- The worst days are solo energy of restlessness and instability as the trader will feel in a rush and drained out.